WELFARE MEASURES TO CENTRAL GOVERNMENT EMPLOYEES

1 Introduction

In this chapter we will see the various welfare measures available to every Central Government Employee as per Seventh Pay Commission recommendation and adopted by Government of India.

2 Allowances

➢ Dearness allowance

➢ House Rent Allowance

➢ Transport allowance

➢ Children’s Education Allowance

➢ Daily allowance on tour

a. Dearness allowance

✓ Based on increase of 6 monthly average in All India Consumer Price Index above 100 points (base year 2001) is determined twice in a year for the period from January to June and July to December

✓ It is calculated on the Pay in the Pay matrix in their level.

✓ The DA admissible as on 01.01.2023 is 42%

b. House Rent Allowance

✓ Allowed with reference to Basic Pay and place of duty at the following rates:

Rates of House Rent Allowance

X Cities

27% of actual Pay in the Pay matrix

Y Cities

18% of actual Pay in the Pay Matrix

Z Cities

9% of actual Pay in the Pay Matrix

✓ During leave, HRA is admissible for the first 180 days only. Beyond this period allowances can be claimed by furnishing requisite medical certificate.

✓ During joining time from one station to another station on transfer, HRA is admissible at the rate of old station.

✓ The above rates of HRA were revised to 27%, 18%, and 9% when DA crossed 25% and further will be revised to 30%, 20% and 10% when DA crosses 50 percent. ✓ HRA shall not be less than Rs 5400, 3600 and 1800 for X, Y, Z class cities respectively.

c. Transport allowance

• All employees are entitled to Transport Allowance at the rate as mentioned below:

d. Children’s Education Allowance

➢ This allowance can be availed by Government Servants for two eldest surviving children.

➢ Age limit for children education allowance is 22 years for physically/ mentally handicapped and 20 years for other than disabled children.

➢ The annual ceiling fixed for reimbursement of Children Education Allowance is Rs 27000 (@2250/- per month).

➢ In case both the spouses are Government Servants, only one of them can avail reimbursement under Children Education Allowance.

➢ Can be claimed once in a financial year only.

➢ The certificate from the head of the institution confirming the ward of government employee studied in the school during the previous academic year should be produced.

➢ Hostel subsidy will be reimbursed up to the maximum limit of Rs.6750/- per month per child for two eldest surviving children. Both hostel subsidy and CEA can be availed concurrently.

➢ Hostel subsidy can be claimed if the children are staying in a hostel with a distance of more than 50 Kms from his residence or from his place of posting.

➢ The above limits would be automatically raised by 25% every time the Dearness Allowance goes up by 50%.

➢ For children with disabilities, reimbursement will be at double the normal rates and the annual ceiling will be Rs.54000/-

f. Daily allowance on tour

a. Casual Leave

➢ Eligible for 8 days Casual Leave and two Restricted Holidays in a calendar year.

➢ It can be combined with special CL only but not with any other kind of leave.

➢ Sundays, Holidays, Restricted Holidays and Weekly off can be suffixed or prefixed to CL.

➢ Sundays and Holidays falling during the period of Casual Leave will not counted as part of Casual Leave.

➢ Casual Leave can be taken for half a day also.

➢ It is intended essentially for short periods and therefore will not normally be granted for more than 5 days at a time.

➢ LTC can be availed during Casual Leave.

➢ CL can be availed while on tour.

b. Special Casual leave

✓ It is a kind of casual leave sanctioned on special occasions like

✓ Participating in national level sports events

✓ Undergoing vasectomy/ tubectomy operation.

✓ Participating in Union/association activities to the office bearers of recognized service unions/associations.

✓ Natural calamity

✓ Election to exercise their franchise having their names in another constituency.

✓ One day for blood donation in recognized blood bank

✓ Divisional head is the sanctioning authority.

✓ LTC can be availed during Special Casual Leave.

✓ Credit of Earned leave will be given in advance with 15 days each on 1st of January and July every year.

✓ Un-availed Joining Time is also credited to EL account with certain restrictions.

✓ Earned leave can be availed up to 180 days at one stretch.

✓ EL can be accumulated up to 300 days + the number of days for which encashment has been allowed along with LTC.

✓ The credit for the half-year in which a Government Servant is appointed will be afforded at the rate of 2 ½ days for each completed calendar month of service.

d. Half Pay Leave

✓ It is credited in advance at the rate of 10 days for each half year on 1st of January and July each year.

✓ It can be availed either with or without medical certificate.

✓ It can be availed converted into commuted leave on support of medical certificate.

✓ Half-pay leave can also be converted into commuted leave without medical certificate in continuation of Maternity Leave (up to 120 days of HPL) or for approved course of study certified to be in public interest (up to 180 days of HPL during the entire service).

✓ The advance credit for the half-year in which a Government Servant is appointed will be at the rate of 5/3 days for each completed calendar month.

e. Commuted Leave

✓ Period of commuted leave permissible is half of number of days of the half pay leave at credit.

✓ Maximum commuted leave permissible without medical certificate is 90 days for approved course of study and 60 days in continuation of Maternity Leave. Otherwise, it is granted on medical certificate only. Twice the number of days of commuted leave availed is debited to HPL Account.

✓ Commuted leave may be granted at the request of the Government servant even when earned leave is available.

f. Maternity Leave

✓ It is granted to both married and unmarried women for 180 days for pregnancy.

✓ Admissible to employees with less than 2 surviving children only

✓ For miscarriage/abortions/induced abortions supported by medical certificate 45 days of maternity leave is admissible in the entire service.

✓ It is not debited to leave account.

✓ Full pay is paid for the period.

✓ This leave can be combined with any other leave without Medical Certificate up to two years.

✓ This period will count for Increment and Pension as well.

g. Paternity Leave

✓ A male Govt. servant (including Apprentice) with less than two surviving children may be granted Paternity Leave for a period of 15 days during the confinement of his wife. i.e., up to 15 days before or up to 6 months after from date of delivery of the child.

✓ Also eligible for 15 days from the date of valid adoption of a child.

✓ During the period of such leave, he shall be paid leave salary equal to the pay drawn immediately before proceeding on leave.

✓ This leave shall not be debited against the leave account and may be combined with any other kind of leave (as in the case of Maternity Leave).

h. Child Care Leave

✓ Women employees / single parent male employee who are having minor children i.e., below the age of 18 years may be granted Child Care Leave for a period of two years (730 days) during the entire service.

✓ This leave eligible for taking care of minor children or to look after any of their needs during Examination, Sickness etc.

✓ This leave will not be granted in more than 3 spells in a Calendar Year. For single parent it is six spells

✓ This can be combined with leave of kinds due and admissible.

✓ CCL cannot be demanded as a matter of right.

✓ Proper approval of leave sanctioning authority is required to avail the leave.

✓ The leave is to be treated like the Earned Leave and sanctioned as such. Saturdays, Sundays, Gazetted holidays etc would also count for CCL, as in the case of Earned Leave.

✓ CCL will not be granted during probation period.

✓ LTC can be availed during CCL.

✓ Minimum 5 days should be availed in each spell.

✓ Full salary for the first 365 days and 80% of salary in the subsequent 365 days is paid.

i. Child adoption leave

✓ Granted to female employees, with less than two surviving children.

✓ For a period of 180 days immediately from the date of adoption.

✓ Adoption should be valid under Guardians and Wards Act 1890.

✓ Leave salary will be equal to pay drawn immediately before proceeding on leave.

✓ Can be combined with any other kind of leave.

✓ In continuation of CAL, any eligible leave can be taken, up to the age of one year of the child.

k. Work Related Injury and illness leave.

✓ Whoever suffers illness or injury that is attributable to or aggravate in the performance of her or his official duties or in consequence of her or his official position.

#Full pay and allowances shall be granted to all employees during the entire period of hospitalization.

#Beyond hospitalization: Full pay and allowance for six monthsimmediately following hospitalization.

#Half pay for 12 months beyond the said 6 months.

✓ Half pay period may be commuted to full pay leave with corresponding number of days of Half pay leave debited from the employee leave account.

✓ No EL or HPL shall be credited during the period that employee is on WRIIL

4 Interest free advances

a. Advance of TA on Tour

✓ It is granted to all the Government servants who are required to proceed on tour. The amount of advance permissible is the expected travelling expenses (inclusive of daily allowance, road mileage, fares and Accommodation expenses - both ways) to cover the expenses for a month on tour.

✓ The advance is to be adjusted within 15 days of completion of tour otherwise penal interest is levied.

b. Advance of T.A. on transfer

✓ It is granted to all Government servants on transfer.

✓ The amount of advance permissible is the amount to cover traveling allowance for self and family (inclusive of composite transfer grant, fare for journey in eligible mode of transportation, cost of transportation of personal effect, etc).

✓ The advance should be adjusted in the final TA claim to be preferred by the official immediately on completion of the journey.

c. Advance of T.A. to the family of a deceased Government servant

✓ Advance of T.A. can be granted to one family member of the deceased employee on behalf of all members.

✓ The amount of advance permissible is 75% of the admissible T.A.

✓ Surety by a permanent Government servant of higher status in prescribed form should be given.

d. Advance for LTC

✓ It is granted to all the Government servants who are entitled for LTC. The amount of advance is limited to 90% of the estimated amount of total fare.

✓ It should be adjusted in LTC bill to be submitted by the within one month of return from the place of visit.

e. Advance in connection with medical treatment

✓ Permissible to all Government servants irrespective of pay limit.

✓ It is granted to meet the medical expenditure of self or members of family as in-patient in the recognized hospitals and as outpatient in the case of cancer and T.B. and for purchase/ replacements, repair/adjustment of admissible artificial appliances.

✓ Certificate from the Medical Officer/Specialist specifying the probable expenditure required for treatment and duration of treatment should be produced.

✓ Maximum amount of advance permissible is Rs 10,000 or amount recommended by the AMA, whichever is less. For major illness 90% of the package deal or amount demanded by the hospital whichever is less. It can be paid in one or more instalments. Any number of advances can be granted when needed. The advance is adjusted from the claim for reimbursement and balance recovered from pay in four instalments. In case of serious illness/ accidents, application may be made by wife or legal heir.

f. Immediate financial relief in case of death

✓ When an employee (permanent or temporary) dies while in service, up to an amount of Rs 25,000, is sanctioned immediately without formal application on receipt of intimation of death.

✓ It is adjusted from the arrears of pay and allowances, leave salary, death gratuity, GPF balance or any other dues payable. The adjustment should be made as soon as possible and in any case within six months from the date of sanction.

5 Interest-bearing advances

a. Advance for construction/Purchase of house/flat/enlargement of living accommodation

The advance is granted to all permanent and temporary (with 5 years' continuous service) Government servants to acquire land, construct house, enlarge house, purchase ready built house, purchase a flat or repayment of other loans taken from non-Government or private sources to build a house or acquire a flat. The amount is paid in lump sum for purchase of house/flat and in two instalments in other cases. The amount of loan should not exceed 34 times of the basic pay or twenty-five lakh or cost of the house. Recovery is made in instalments not exceeding 180 for loan and 60 for interest. Present interest rate is 7.9% (Up to 31.03.2022).

b. Personal Computer Advance

All Government servants are eligible for this advance. Maximum amount permissible is Rs 50,000 or the anticipated price of the computer, whichever is less. A second or subsequent advance for purchase of a personal computer cannot be granted before expiry of 3 years from the drawal of the earlier allowance. May be allowed for a maximum five times in the entire service. The advance is recovered in not more than 150 instalments. interest rate is 9.8% for the year 2021-22.Total recovery on account of all advances including computer advance, taken by a government servant should not exceed 50% of the total emoluments.

6 Other Welfare schemes

a. Productivity-Linked Bonus

Bonus granted equivalent to emoluments for certain number of days for the relevant financial year. The PLB is admissible to all non-Gazetted employees and is restricted to a maximum of Rs.7000 p.m.

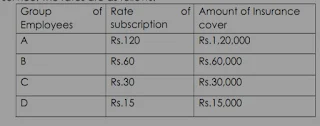

b. Group Insurance Scheme

#The scheme is applicable to all Central Government employees entering service. The rates are as follows:

#An employee joining service after 1st January of a year will be enrolled as member from the 1st January of next year only.

#Out of the monthly subscription, 30% is apportioned to Insurance Fund and 70% to Savings Fund.

# If the employee dies while in service, the nominee/family of the deceased employee will be paid the accumulations in Savings Fund as well as the amount of insurance cover.

#If the employee ceases to be in service due to retirement, resignation, etc., the employee will be paid only the accumulations in Savings Fund.

#The subscription is eligible for Income Tax rebate under section 88 of Income Tax Act.

c. Leave Travel Concession

• Any employee with one year of continuous service on the date of journey performed by him/her and/or his/her family is eligible.

• Government servants whose spouses are working in Indian Railways /National airlines are not eligible for LTC.

• LTC to Hometown

• It can be availed once in a block of two calendar years.

• Hometown of the official once declared in the service book is treated as final.

• In exceptional circumstances, the Head of the Department may authorize a change, only once during entire service.

• An employee (including unmarried) having his family at his Hometown can avail of this concession for himself alone every year instead of having it for both self and family once in two years.

• LTC to any place in India

• This concession is admissible in lieu of one of the two journeys to hometown in a block of four years. The present block is 2018-21

• Available for travel to any place in India including employee’s Hometown.

• Officials availing LTC to Hometown for self every year are not entitled to LTC to anywhere in India.

Entitlement of fresh recruits:

Fresh recruits are allowed to travel to their home town along with their families on three occasions in a block of four years and any place in India on the fourth occasion. This facility is available for the first two blocks of four years after joining the government service for the first time.

(i) The first two blocks of four years will apply with reference to the date of joining. The first two blocks of four years will be personal to them. On completion of eight years, they will be treated as par with the regular employees.

(ii) No carry-over of LTC is allowed for a fresh recruit. A fresh recruit whose home town and headquarters are the same cannot avail LTC to home town.

• Advance for LTC

• Up to 90% of the fare can be taken as advance.

• Advance admissible for both onward and return journeys if the leave taken by the official does not exceed 90 days.

• Otherwise, advance may be drawn for the outward journey only.

• The official should furnish Railway ticket numbers, PNR No., etc., to the competent authority within ten days of drawal of the advance.

• When advance is taken, the claim should be submitted within one month from the date of return journey.

• Encashment of EL during LTC:

• Limited to 10 days of earned leave on one occasion without linkage to the number of days and nature of leave availed and 60 days in entire career.

• Will not be deducted while computing the maximum admissible for encashment at the time of quitting service.

• The balance at credit should not be less than 30 days after deducting the total of leave, if any availed plus leave for which encashment was availed.

Definition of family A government servant’s wife/husband:

Fully dependent

1. Two surviving unmarried children/step children/adopted children

2. Divorced / widowed married daughter

3. Unmarried minor brothers

4. Unmarried/divorced/ abandoned/ separated/ widowed sisters

5. Parents/ or step parents

For deciding dependency, altogether income should not exceed minimum

family pension + Dearness allowance (9000 + DA)

7 Service unions

Recognition of Service Associations

• CCS (Recognition of Service Associations) Rules 1993 came into force from 15.11.1993.

• Applicable to Service Associations of all Central Govt servants covered by CCS(Conduct) Rules 1964.

• Conditions for recognition

✓ Application to be submitted with Memorandum of Association, Constitution, Bye-laws, Names of Office-bearers etc.

✓ Primary object of Association to be of promoting common service interest of members of a distant category

✓ To represent at least 35% of total number of employees.

✓ Employees in service to be members or office bearers. However, as a transit measure, retired/ex-employees permitted to continue up to two years from the date of recognition.

✓ Association not to represent interests of any caste, tribe, religion, etc.

✓ Funds exclusively of subscriptions and Govt grants, if any, to be applied only for the objects of the Association.

• Check-off system of verification

✓ Subscription to be deducted from payrolls on written consent of the official.

✓ More than one association not allowed.

✓ Check-off system of verification followed to verify the membership.

✓ Other schedule for conduct of verification on membership also to be followed.

• Facilities for trade union activities

✓ Holding meetings in Office premises

✓ Display of Notices in the office premises

8 Incentives for usage of Hindi

Cash awards for passing the examination through training classes under Hindi Teaching Scheme are granted to Gazetted and Non-Gazetted Central Government employees on the basis of marks obtained at the following rates:

Cash awards for acquitting credibility in Hindi Typing/Stenography examination/Electronic Type writers, computers/ word processors under Hindi teaching scheme. Non- Gazetted employees eligible on the basis of marks obtained.

• Hindi Personal Pay

✓ Personal pay equal to one increment for 12 months granted for

passing the Hindi/Hindi Typewriting/Hindi stenography examinations of HTS

✓ Personal pay will be admissible only to those employees for whom the particular course has been prescribed as the final course of study.